Starting and running a business within the European Union (EU) can be highly rewarding — but it is certainly not without challenges. Many entrepreneurs face common issues such as high taxes, complex bureaucracy, and strict regulatory frameworks. For small businesses, freelancers, digital nomads, and global startups, these barriers can make entry and expansion difficult.

Yet, the EU remains one of the world’s most attractive and competitive economic regions. Its member states continue to innovate through digital governance, strategic tax reforms, cost-efficient markets, and incentives designed specifically to attract foreign founders.

As we move into 2026, several European jurisdictions are actively positioning themselves as top business destinations — each offering a unique blend of benefits. Understanding these competitive advantages can help entrepreneurs choose the best place to establish or grow their EU presence.

Below is a detailed and insightful analysis of the countries emerging as leading business havens and why they stand out.

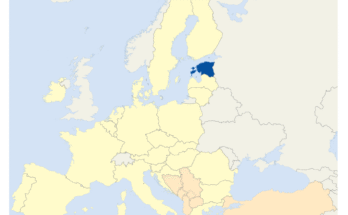

1. Estonia — The Digital Frontier of EU Entrepreneurship

Estonia has earned global recognition as one of the most digitally advanced nations on earth. Its approach to governance has redefined how business in the EU can operate.

The Power of the e-Residency Program

Estonia’s flagship initiative — the e-Residency program — enables anyone in the world to:

- Start an EU-based company fully online

- Manage the entire business remotely

- Access EU financial infrastructure

- Use secure digital signatures

- Enjoy transparent regulatory compliance

This makes Estonia particularly attractive for:

- Freelancers

- IT consultants

- SaaS founders

- Digital agencies

- Remote-first startups

For entrepreneurs who value minimal bureaucracy, digital efficiency, and predictable regulation, Estonia stands as the ultimate EU remote-business hub. For details please check out our blog on Estonia

2. Low Tax Jurisdictions Competing for Global Startups

Within the EU, corporate tax rates vary widely. Some countries intentionally use low-tax models to attract foreign companies.

Hungary — EU’s Lowest Corporate Tax (9%)

Hungary is one of the most competitive EU jurisdictions thanks to:

- 9% corporate income tax rate (lowest in the EU)

- Additional tax incentives for R&D and innovation

- A straightforward incorporation process

- Strategic Central European location

This makes Hungary ideal for small companies and foreign founders aiming to reduce operational expenses while accessing the EU market.

Slovakia — Stability and Modern Tax Policy

Slovakia combines:

- A progressive corporate tax structure

- A stable EU regulatory environment

- Strong export-driven industrial sectors

- A central logistics position for European trade

It appeals especially to manufacturing businesses, automotive suppliers, and SMEs focusing on Central Europe’s export markets.

3. Sector-Specific Hubs and Cost-Competitive Destinations

Some European countries stand out not because of taxation alone, but due to sector suitability, infrastructure readiness, and cost advantages.

Romania — A Fast-Growing Hub for Tech and Digital Industries

Romania has become a competitive destination for:

- Fintech startups

- IT outsourcing and development teams

- Digital scale-ups

- Business Process Outsourcing (BPO)

- Shared Service Centers (SSC)

- Manufacturing and export industries

Romania offers EU-level stability with significantly lower operational costs, making it a preferred destination for companies looking to scale efficiently.

Non-EU Context: Ukraine and Belarus (Relevant for Regional Strategy)

While not part of the EU, Ukraine and Belarus remain relevant within the broader European business ecosystem.

- Ukraine stands out for IT talent, affordable operations, agritech, logistics, and export-driven SMEs.

- Belarus has historically been strong in IT and product engineering sectors.

These markets appeal mainly to businesses looking for regional diversification, tech development teams, or cost-effective labor.

4. Countries Offering Balanced, All-Round Advantages

A few European nations distinguish themselves by offering a comprehensive combination of:

- Strategic geographic location

- Attractive tax structures

- Growing digital ecosystems

- Good quality of life

- Strong infrastructure

Bulgaria

Bulgaria has become one of Europe’s hidden gems due to:

- A low corporate tax rate (10%)

- Affordable cost of doing business

- Fast company registration processes

- A steadily growing tech ecosystem

It’s especially suitable for SMEs, tech entrepreneurs, and remote teams. Check out the Details: Bulgaria Income Tax.

Portugal

Portugal’s competitive strengths include:

- Startup-friendly policies

- Strong digital nomad attraction

- Tech hubs like Lisbon and Porto

- Skilled English-speaking workforce

Its mix of innovation, lifestyle, and investment incentives continues to draw global founders. For details check out our blog on Portugal.

Spain

Spain is evolving into a major EU business hub with:

- The new Startup Law supporting digital entrepreneurship

- Growing fintech and AI ecosystems

- Strong internal consumer market

- Excellent logistics and infrastructure

Spain appeals to businesses wanting both stability and a large domestic market. For details check out our blog on Spain.

Conclusion — Choosing the Right EU Business Destination in 2026

Europe is not competing on any single dimension. Instead, each country is positioning itself uniquely:

- Estonia → Digital governance & remote-friendly business

- Hungary → Ultra-low corporate taxes

- Slovakia → Stable industrial and export environment

- Romania → Cost-efficient tech and digital growth

- Bulgaria / Portugal / Spain → Balanced policy, innovation, and strategic advantages

- Ukraine (non-EU) → Tech talent and cost competitiveness (regional relevance)

The “best” EU country depends on the nature of your business, your operational model, and the level of digital or physical presence you require.

Disclaimer

This article is for informational purposes only. Business conditions, tax laws, and regulatory environments may change over time. Entrepreneurs are advised to exercise professional prudence, conduct on-ground research, and consult qualified specialists before making any business or investment decisions.