Why Ukraine? Main Features for Businesses

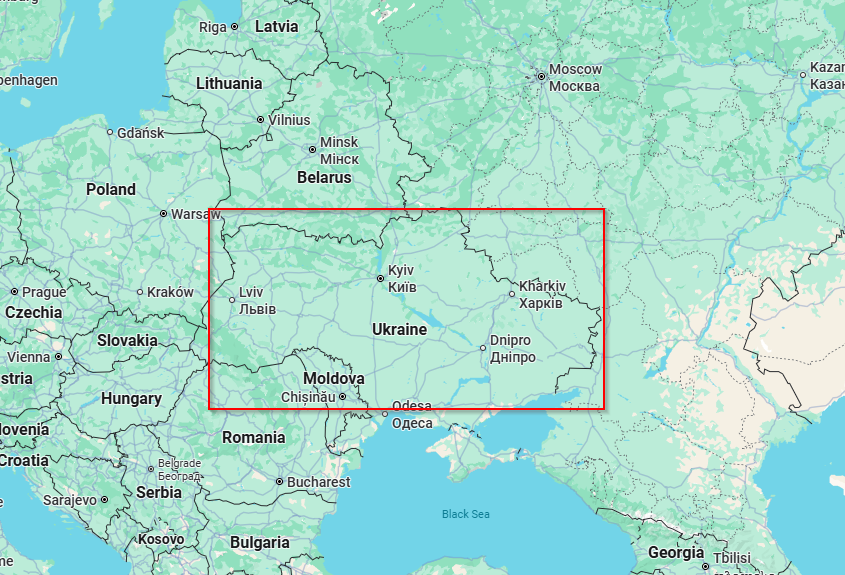

- Strategic Location & Market Size: Ukraine borders the EU, offering access to over 40 million consumers, Black Sea logistics, and strong links to Central/Eastern Europe.

- Large, Skilled, Affordable Workforce: Ukraine is known for its IT talent, engineers, and highly educated workers at a fraction of Western European labor costs.

- Reform Drive & EU Orientation: Commitment to deregulation, digitalization, and alignment with EU law, including tax reform, transparency, and legal certainty.

- Key Sectors: Agriculture, food processing, energy, chemicals, metals, machinery, IT/tech, e-commerce, and professional services.

Best suited businesses: IT and tech startups, agribusiness, logistics, manufacturing, export-oriented SMEs, green and renewable projects.

Core Legal Forms of Companies

| Legal Form | Minimum Capital | Founders | Key Points |

|---|---|---|---|

| Limited Liability Company (LLC/TOV) | ~€1 (UAH 1 minimum) | 1+ (person/entity) | Most common; limited liability, shareholders, flexible |

| Joint Stock Company (JSC/AT) | ~€30,000 | 1+ | Higher capital; can issue shares, suited for large IPOs |

| Private Entrepreneur (FOP/PE) | None | 1 | Simple registration, for solo activities, unlimited liability |

| Branch / Representative Office | None | Foreign company | Not a separate legal entity, no liability shield |

Key Points:

- 100% foreign ownership is allowed for all company types.

- No residency requirement for founders or directors.

- LLC is the default and most flexible legal form.

- Company can be fully foreign-owned and managed remotely (with local address).

Taxation System and Optimization Opportunities

Corporate Income Tax (CIT)

- Standard Rate: 18% on worldwide profits for Ukrainian-resident entities.

- Tax Base: Calculated from accounting profit, adjusted for tax purposes.

- Loss Carryforward: Unlimited forward with restrictions for large taxpayers; no carryback.

- Accelerated Depreciation: Certain industries can accelerate depreciation of new assets (especially after 2022 reforms).

Key Optimization Points

- IT/Tech “Diia.City” regime: Special 9% CIT on distributed profits (or 18% on regular profit), simplified compliance, and reduced social charges for certified companies.

- Single Tax System (“Unified Tax”): For small businesses (annual revenue ≤ UAH 7.8 million/€180,000), pay 5% of turnover (no VAT) or 3% plus VAT—favorable for small traders, freelancers, and FOPs.

- Free Economic Zone (FEZ): Formerly offered full or partial CIT exemptions, but most are suspended due to ongoing conflict.

Examples

- IT Company in Diia.City: Can choose 9% tax on dividends instead of 18% CIT; Tech startups pay only when distributing profit.

- Small business (Single Tax): Artisan with €100,000 turnover pays 5% of €100,000 = €5,000 total tax annually, no CIT or VAT.

Other Taxes

| Tax | Rate/Threshold | Comments |

|---|---|---|

| VAT | 20% standard; 7% medicinal | VAT registration if annual turnover > UAH 1 million (~€23,000) |

| Social Security (SSC) | 22% employer on gross pay | Minimum contribution applies regardless of hours; IT/Diia.City: 22% SSC only from minimum wage (UAH 7,100/month) |

| Personal Income Tax (PIT) | 18% | Employee salary, director’s remuneration |

| Military Tax | 1.5% | Temporary, all individual income |

| Withholding Tax (WHT) | 15% | On dividends, interest, royalties to non-residents (treaties may reduce; check black-list exceptions) |

| Real Estate Tax | 1.5% up to 3% | Per square meter/year; rates vary by municipality |

- VAT: Compulsory registration if threshold is crossed; voluntary possible below.

- Social Security: Minimum base is national minimum wage per employee, even for part-timers.

- Dividends: No WHT for in-country payment; Standard 15% to foreign shareholders (double tax treaties may reduce).

Ease of Doing Business & Government Policy

- Ranking: Ukraine rose to 64th in the last World Bank Doing Business report (2019), with major improvements in company registration, tax compliance, and cross-border trade.

- Online Government Services: “Diia” portal enables online company setup, digital signatures, and document filings.

- Sector Focus:

- Lenient: IT, agriculture/food, renewables, logistics, e-commerce, and creative industries.

- Stricter: Telecom, banking, insurance, arms/dual use, gambling (all subject to licensing and enhanced oversight), and sectors under strategic defense controls.

Government Policy:

- Rapid digital transformation, streamlined licensing, export-friendly incentives, and EU-aligned reforms.

- Major focus on postwar reconstruction, green energy, and export growth (especially “Made in Ukraine”/localization programs).

Company Formation: Process, Cost, and Shareholding

Steps

- Name Reservation: Not required; register directly via government e-portal or notary.

- Document Preparation: Charter, decision of founder(s), local address, director and shareholder details.

- State Registration: Submit through online portal or local Registration Office (usually 1–2 business days).

- Bank Account Opening: After registration; in-person or remotely via authorized banking agents.

- Tax/VAT Registration: Simultaneous or immediate after company set-up.

- SSC and Employment Registration: Upon hiring or with director’s appointment as employee.

Timeline & Costs

| Item | Typical Cost (2025) |

|---|---|

| State Registration | Free (state fee abolished) |

| Notary Fees | €20–€100 |

| Translation/Legal | €50–€300 |

| Share Capital | €1 (UAH 1 minimum for LLC) |

| Professional Setup | €300–€1,000 (turnkey) |

| Virtual Office | €120–€300/year |

- Physical Presence: Not required; remote digital setup via e-portal is possible.

- Shareholding: 100% foreign ownership, one shareholder (individual or legal entity) minimum.

Grants and Funding Opportunities

- EU4Business & EBRD Programs: Grants, loans, and technical support for SMEs, green energy, and digitalization (grants usually €5,000–€50,000).

- Ukrainian Startup Fund: Grants of $25,000–$50,000 per project for tech startups, offered through regular competitions.

- Local Grants: City/oblast programs supporting job creation and export infrastructure, especially in IT, agribusiness, and manufacturing.

- International Support: Access to World Bank, USAID, IFC, and UNDP programs focused on resilience, digital transformation, and green recovery.

Governance and Compliance

- Annual Reporting: All companies must file financial statements and CIT returns, regardless of activity or turnover.

- Audit Requirement: Mandatory for JSCs and large LLCs (assets > €4m, revenue > €8m, staff >50).

- ESG & Sustainability: Large companies required to comply with EU CSRD-aligned non-financial disclosures from 2025.

- Ultimate Beneficial Owner (UBO): Compulsory registration; changes must be filed within 30 days.

- Electronic Invoicing & Digital Reporting: VAT-registered companies must issue e-invoices (e-Document) and submit VAT returns monthly.

- Transfer Pricing: Required for all related-party transactions >UAH 10m (~€230,000), with OECD-aligned documentation.

Conclusion

Ukraine offers a dynamic, digitally transforming, and investment-welcoming corporate tax environment:

Key Advantages:

- 18% CIT, with reduced rates for IT, tech, and small businesses via Diia.City and Single Tax regimes.

- 0% or treaty-reduced WHT for foreign dividends and intra-group transactions.

- Rapid, fully digital setup for LLCs (UAH 1/EUR 1 capital), with no local director or presence required.

- Strong support for IT, agribusiness, green energy, and export sectors with dedicated grants.

- Robust government push towards EU harmonization, sustainability, and simplified compliance.

Considerations:

- VAT, payroll/social tax, and WHT are strictly enforced.

- New ESG/UBO/transfer pricing rules increase compliance for larger firms.

- Sectors with national-security implications (defense, telecom, finance) face more licensing and scrutiny.

- Ongoing conflict with Russia affects physical risks and may impact some sectors (especially in border or war-affected regions).

Bottom Line: Ukraine remains an exceptionally cost-competitive, digital-first, and reform-focused business environment for entrepreneurs and international investors, particularly those in high-growth sectors, IT, and exports. With EU reforms accelerating, a skilled workforce, and growing international funding, it provides a unique platform for businesses seeking to access both Eastern European and global markets.

awesome