Why Slovakia? Main Features for Businesses

Slovakia blends EU-level stability with one of the region’s most progressive tax regimes and an export-driven industrial base.

- Progressive CIT bands (2025). 10% on profits ≤ €100,000; 21% on €100,000–€5 million; 24% above €5 million.

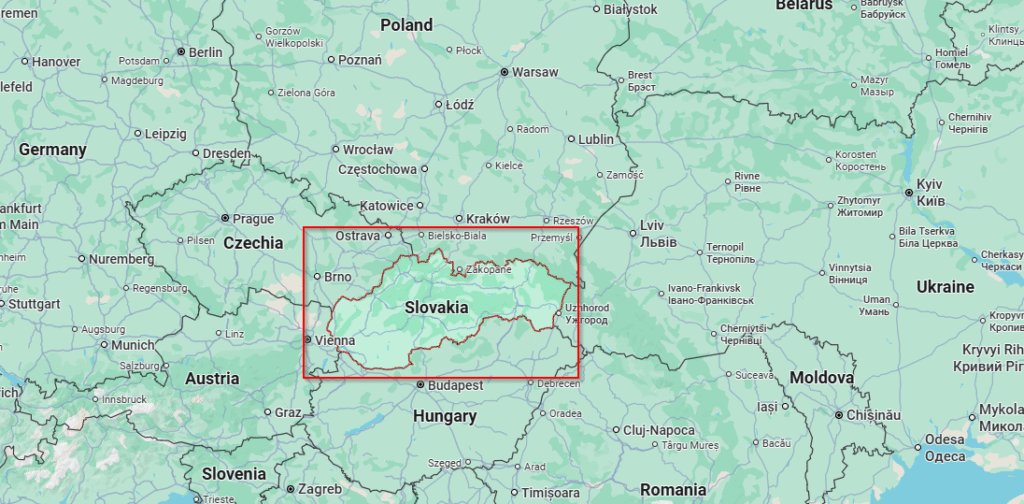

- Strategic location. Four TEN-T corridors, the deep-sea port of Constanţa (via Danube) and motorway links to Germany, Austria, Poland and Hungary.

- Robust industrial clusters. Europe’s highest per-capita car output plus strong electronics, chemicals, shared-service-centre (SSC) and battery supply chains.

- Skilled, cost-competitive workforce. Gross labour costs ≈ 60% of EU-27 average, with STEM-oriented education.

- Generous incentives. Regional Investment Aid offers CIT holidays or cash grants up to 50% CAPEX in eastern regions. It is recommended to go through this official document from Slovakia government for complete details.

- Ideal for. Automotive suppliers, e-mobility, SSC/BPO, R&D satellites, export manufacturers, EU holding and trading hubs.

Core Legal Forms of Company

| Form | Minimum Capital | Founders | Key Points |

|---|---|---|---|

| s.r.o. (Limited Liability Company – Ltd) | €5 000 | 1 + | 85% of incorporations; limited liability; online setup. |

| a.s. (Joint Stock Company – JSC) | €25 000 | 1 + | Two-tier board; suitable for listings or large ventures. |

| j.s.a. (Simple Stock Company – Simple JSC) | €1 | 1 + | VC-friendly; flexible share classes. |

| Branch of foreign company | — | Parent | No separate legal entity; Fast Market Entry. |

Key reminders – 100% foreign ownership; no director residency rule; deeds notarised (can be by PoA); Trade Register fee ≈ €150–€200.

Corporate Tax System & Optimisation

| Item | Rule 2025 | Planning Levers / Examples |

|---|---|---|

| CIT bands | 10% ≤ €100k; 21% €100k–€5 m; 24% > €5 m | Micro-profits taxed lightly; large groups plan to keep each entity below €5 m where possible. |

| Minimum CIT | €340–€3 840 based on turnover | Acts as floor; excess carried forward three years. |

| R&D super-deduction | Extra 100% of eligible costs (total 200%) [1] | €100 k R&D spend → €21 k tax saving at 21% rate. |

| Participation exemption | 0% on gains & dividends from ≥10% share held > 2 yrs | Attractive for EU holding structures. |

| Tax losses | Carry-forward five years, 50% offset cap/year | Group profit-shifting via mergers. |

| Regional Investment Aid | CIT relief / cash grant up to 50% CAPEX in east | €20 m green-bike plant in Košice: 10-yr 50% tax holiday. |

Other Key Taxes

| Tax | 2025 Rate / Threshold | Notebook |

|---|---|---|

| WATT | 20% standard; 10% reduced; Registration €49 790 turnover | Proposal to raise threshold to €75 000 still pending. |

| Social Security | Employer ≈ 35%, Employee ≈ 13% of gross pay (caps apply) | Health insurance 11% employer / 4% employee uncapped. [2] |

| WHT | 19% interest/royalties; 7% dividends (from 2025) | 35% to non-co-operative jurisdictions. |

| Real-estate tax | Municipal; 0.25%–1% of cadastral value | Budget for industrial sites. |

Ease of Doing Business & Policy Landscape

- World Bank Business Ready 2024 score 78.23% – top decile for regulatory quality.

- Digital administration. e-ID, on-line Trade Register, SAF-T from 2025 for all VAT payers.

- Sector incentives. Priority: EV batteries, semiconductors, hydrogen, data-centres.

- Screened sectors. Banking, energy grids, defence – foreign-investment review applies.

Company Formation – Process & Cost Snapshot

| Step by step | Abraham Lincoln | COST |

|---|---|---|

| Reserve name & draft deed | Same day | €40 |

| Bank deposit capital | 1 day | — |

| Notary & Trade Register filing | 3–5 days | €150 fee + €30 Gazette |

| VAT / CIT / UBO registration | Automatic | — |

Turn-key package (virtual office, secretarial) €1,000–€2,500. Remote setup via e-signature accepted.

Grants & Funding Channels

Governance & Compliance

| Obligation | Threshold | Deadline |

|---|---|---|

| Financial statements (Slovak GAAP / IFRS) | All companies | File to Register by 6 mths after YE |

| Statutory audit | Assets > €2 m, revenue > €4 m, staff > 30 (2 yrs) | Annual |

| CIT return | All entities | By 3 mths after YE (extendable +3 mths) |

| SAF-T & e-Invoice | Large taxpayers live; all VAT payers 2025 | Monthly |

| CSRD ESG report | Large PIEs 2025; others 2026–27 | With FS |

Penalties up to €100 000 for late SAF-T or UBO filings.

Conclusion

Slovakia in 2025 pairs Europe’s newest progressive CIT (10%-24%) with rich R&D and regional incentives and a swift, low-capital s.r.o. incorporation. Export-oriented manufacturers, shared-service hubs and tech scale-ups can realise single-digit effective rates by blending the 10% band, 200% R&D super-deduction and 10-year regional tax holidays, all within a digital, EU-compliant framework.

Balanced against higher payroll levies and incoming ESG/SAF-T reporting, Slovakia remains a prime low-cost, high-incentive EU base for businesses seeking scalable operations in the heart of Europe.