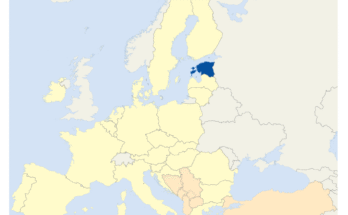

Starting and running a business in the European Union can be complex. High taxes, bureaucracy, and regulatory hurdles often make growth challenging for small businesses, freelancers, and startups. In this landscape, Estonia is quickly becoming the most business-friendly EU country in 2026.

Resources used for this studies are: Estonia e-Residency; Estonia Tax Authority

Here’s why Estonia is attracting entrepreneurs worldwide and how it can benefit your business.

1. Tax Advantages That Encourage Growth

Estonia’s corporate tax system is revolutionary. Unlike most EU countries, Estonia does not tax reinvested profits. Taxes are only applied when profits are distributed as dividends.

Benefits for Businesses:

- 0% corporate tax on reinvested earnings

- Encourages growth and innovation

- Simplified tax compliance compared to other EU nations

For startups and businesses looking to reinvest profits into expansion, technology, or team growth, this system is highly advantageous.

2. Effortless Company Formation

Estonia is renowned for its digital-first approach. Entrepreneurs worldwide can establish and manage a company entirely online through Estonia’s e-Residency program. This means no physical presence is required.

Why It Matters:

- Fully digital company registration

- Online banking and administration

- Reduced bureaucracy and reporting hassles

This simplicity is perfect for freelancers, consultants, and remote-first businesses aiming to focus on growth rather than paperwork.

3. A Competitive and Supportive Business Environment

Estonia excels in ease of doing business, digital infrastructure, and regulatory efficiency. Entrepreneurs enjoy low administrative burdens, making it easier to focus on innovation, client relationships, and scaling operations.

Highlights:

- Streamlined compliance and reporting

- Digital services for tax, banking, and company management

- Friendly ecosystem for startups and SMEs

4. Who Should Choose Estonia in 2026

Estonia is ideal for:

- Freelancers and remote consultants

- Startups and small digital businesses

- Companies reinvesting profits rather than paying out large dividends

For professionals with experience in accounting, advisory, or digital services, Estonia offers an ideal balance of tax efficiency, digital convenience, and growth-friendly policies.

5. Comparing Estonia to Other EU Business Hubs

| Country | Key Strengths | Best For |

|---|---|---|

| Estonia | Zero tax on reinvested profits, simple digital setup | Freelancers, startups, small digital businesses |

| Ireland / Cyprus / Bulgaria | Low corporate tax, strong tax treaty networks | Companies with regular profit distributions |

| Germany / France / Netherlands | Robust infrastructure, access to funding, regulatory stability | Large-scale or multinational businesses |

While countries like Ireland or Bulgaria may appeal to specific businesses, Estonia provides the most balanced solution for small to medium enterprises looking for growth, efficiency, and ease of management.

6. Conclusion

For startups, freelancers, and SMEs aiming to expand in the EU in 2026, Estonia offers unmatched advantages:

- Growth-friendly tax policies

- Digital-first administration

- Competitive, streamlined business environment

If your goal is to build a business that thrives with minimal bureaucracy while maximizing reinvestment potential, Estonia is the EU destination to consider.

Disclaimer

The content of this article is intended for informational purposes only. It does not constitute professional, legal, or financial advice. Readers should exercise professional prudence, conduct thorough research, and analyze on-ground conditions before making any business decisions.

Please check out this Article as well: Estonia Corporate Environment